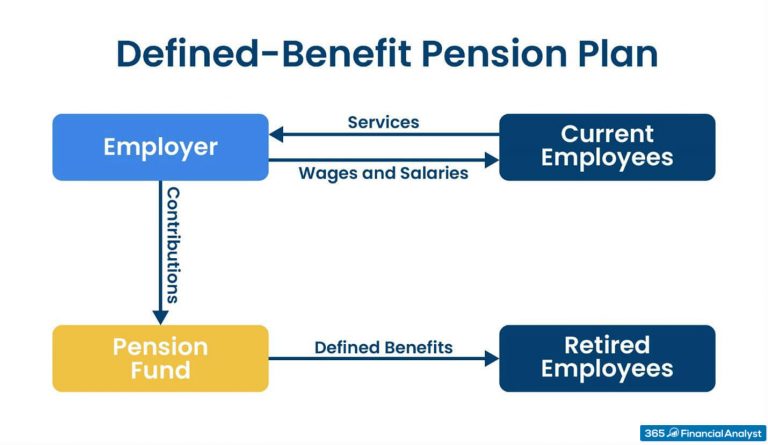

Annual contribution levels are calculated based on several factors, including age, compensation, and retirement age. Earnings grow tax-deferred and are taxable when withdrawn.Ī Personal Defined Benefit Plan is funded with employer contributions only and must be funded annually. What are the tax advantages of a Personal Defined Benefit Plan?Ĭontributions are generally 100% tax-deductible, within IRS limits. It’s for people who are looking for a quick way to increase their retirement assets, most likely highly compensated business owners, partners, and key employees who are in their peak earning years. Who is a Personal Defined Benefit Plan for?Ī Personal Defined Benefit Plan may be best for professionals age 50 or over who can make annual contributions of $90,000 or more for at least five years and who have few, if any, employees. Schwab must receive the form by November 15 in order to establish a plan effective for the current year. The first step is to complete a complimentary Funding Proposal Worksheet. This plan can take up to three months to set up, so you’ll want to start early. How do I establish a plan and how long will it take? If you have a specific question that’s not answered here, please call us at 80. Have questions about our Personal Defined Benefit Plan? Here are responses to some of the most common questions we hear. Starting a new Schwab Personal Defined Benefit PlanĪnnual service fee: $2,600 for up to 3 participants. Environmental, Social and Governance (ESG) Investing.Bond Funds, Bond ETFs, and Preferred Securities.

ADRs, Foreign Ordinaries & Canadian Stocks.

0 kommentar(er)

0 kommentar(er)